Nirav Shah, Global Director (Growth Fields, Re-refining, LNG/Gas processing) at Evonik, explores the integration of pyrolysis oil into refining and petrochemical processes, the hurdles that come with this, and the innovative solutions driving adoption at scale.

Sustainability initiatives have been front of mind for the petrochemical and refining industries in recent years, driving strategies to reduce environmental footprints and promote more responsible resource use.

As a result, refinery and petrochemical industries are increasingly exploring alternative, sustainable feedstocks to decarbonise their operations and support the transition to a more circular economy.

Among these alternatives, pyrolysis oil, which is produced through the thermal decomposition of plastic waste, is growing in popularity. Its potential as a feedstock for steam crackers is what’s attracting particular attention due to two core benefits:

- Enabling more chemical recycling

- Reducing dependence on fossil-based inputs

However, despite recent advancements, the full potential of pyrolysis oil is yet to be realised due to technical, economic, infrastructural, and legislative challenges.

But refining and petrochemical industries need to act fast as the industry remains among the most significant contributors to air pollution, affecting the quality of air we all breathe.

Sustainability in the current landscape

Sustainable feedstocks are no longer a niche topic; they’re a driving force behind the ongoing transformations of the refining and petrochemical industries. What began as an internal conversation in labs and amongst sustainability teams is now a central pillar of long-term business strategy for the sector.

Many leading refiners and petrochemical companies have set goals to increase the use of alternative, non-fossil feedstocks as part of their broader decarbonisation commitments, driven by regulatory pressure, investor expectations, and consumer demand for more sustainable products.

As companies face mounting pressure to decarbonise operations, reduce plastic waste, and meet increasingly stringent environmental regulations, the search for viable, scalable alternatives to fossil-based inputs grows.

Another driving force comes from regulatory policies, such as the European Union’s Circular Economy Action Plan, which aims to make sustainable products the norm and significantly increase the use of secondary raw materials.

In the United States, state-level initiatives are introducing mandates for recycled content and extended producer responsibility (EPR), while Asia is accelerating efforts through a mix of government targets and industrial expansion.

In this landscape, sustainable feedstocks have moved from a “nice-to-have” to a “must-have”, not just to comply with regulation, but to maintain competitiveness and future-proof operations.

Recent industry analysis shows a rise in pyrolysis-based efforts globally. In Europe alone, pyrolysis facilities currently represent around 60% of operating chemical recycling capacity, with projections indicating a nearly sevenfold increase in total capacity, potentially reaching up to 1.7 million tonnes per year if all proposed projects come online.

These numbers highlight that while the technology is proven, its contribution to overall plastics production remains small, potentially just around 1% of global polyethylene production, indicating that adoption is still in the early stages of scaling up.

Pyrolysis explained

Pyrolysis oil is derived from end-of-life plastics through a high-temperature, oxygen-free process. At the core of its appeal is its role as a feedstock in steam cracking, a carbon-intensive processes in petrochemical production.

Traditionally reliant on fossil-derived liquids, steam crackers can incorporate pyrolysis oil to reduce reliance on virgin hydrocarbons and divert plastic waste from landfills and incineration.

From a sustainability standpoint, this represents a significant win. Chemical recycling via pyrolysis offers a closed-loop pathway where plastic waste is transformed back into raw materials for new plastic production, rather than being downcycled or lost from the value chain, directly supporting the vision of a circular plastics economy.

However, pyrolysis oil in its raw form isn’t plug-and-play. Its composition varies depending on the input plastic waste stream and the conditions of pyrolysis, often resulting in high levels of contaminants such as chlorides, silicon, nitrogen, TAN (total acid number) and trace metals. These impurities can damage downstream units, poison catalysts, and lead to operational inefficiencies or regulatory non-compliance.

Upgrading and purifying pyrolysis oil

For pyrolysis oil to be suitable for use in refineries or steam crackers, it must undergo upgrading and purification. The two typical approaches for this are:

- Adsorbent-based purification

- Hydrotreating technologies

Adsorbent technology has become a prevalent solution in early-stage and mid-scale operations due to its flexibility and relatively low capital and operational expenditure.

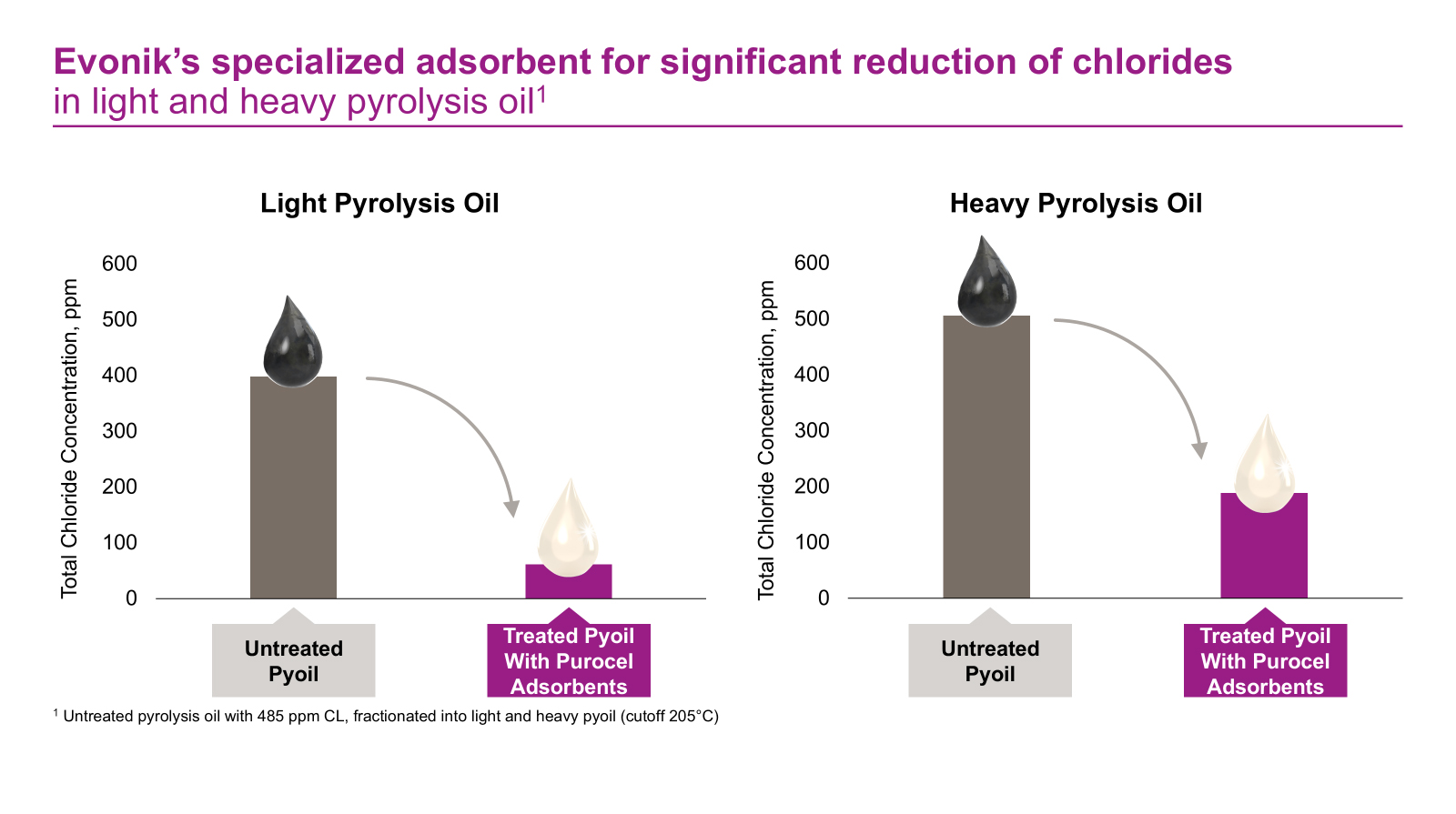

Adsorbent-based purification leverages tailored materials to selectively capture contaminants like chlorides silicon, nitrogen, TAN and metals. Innovations in adsorbent performance, some offering three times the removal efficiency of conventional options, are helping enable higher proportions of pyrolysis oil in feedstock blends without compromising plant reliability.

Hydrotreating, on the other hand, involves catalytic treatment with hydrogen to remove impurities, saturate olefins, diolefins, aromatics, and stabilise the oil.

This method is considered a level-up from adsorbent technology but is also significantly more resource-intensive. It is currently adopted by a smaller portion of the industry, and often by more advanced facilities with sufficient hydrogen infrastructure and financial capacity to support higher CAPEX/OPEX requirements.

Notably, some advanced solutions integrate both methods in a modular, skid-mounted format, offering pretreatment “polishing” capabilities before pyrolysis oil enters the main process train.

These systems are often adaptable to varying plant sizes and feed compositions, providing a scalable pathway for refineries looking to trial or expand pyrolysis oil usage. One such example includes Evonik Catalysts’ Purocel™ portfolio, which combines adsorbent, hydrotreating, and polishing technologies to meet stringent feedstock specifications.

Overcoming barriers to scale

The pyrolysis oil value chain still faces some systemic challenges to be addressed.

Among these challenges is feedstock availability because issues like plastic waste leakage, insufficient collection infrastructure, and contamination from non-plastic materials (like glass or metals) can limit the volume and quality of the input material used for pyrolysis processes.

To overcome feedstock availability challenges, more investment in upstream sorting and preprocessing is needed to ensure a consistent and usable supply of feedstock.

From a technology perspective, while many adsorbent systems have proven effective at smaller scales, upscaling remains a key hurdle. This is because uniformity in product quality, process stability, and impurity management are critical concerns, particularly as pyrolysis oil content in crackers approaches the double-digit percentage range. Beyond a certain threshold, even minor impurities can cause outsized operational risks.

Unlocking broader applications and adoption

Looking ahead, the potential of pyrolysis oil goes beyond steam cracking. With appropriate upgrading and purification, refineries could explore its use in various processing units, including fluid catalytic cracking or hydrotreaters or hydrocrackers There’s also a growing industry interest in blending pyrolysis oil with bio-oils or other waste-derived feedstocks to diversify inputs and boost sustainability.

To drive this evolution, continued innovation in catalysts and adsorbents for impurity removal, and integrated system design is essential. This is achievable with the help of some of today’s most advanced solutions, such as regenerable adsorbents and regenerated/rejuvenated catalysts like those in Evonik’s Purocel™ series, which deliver lower carbon footprints and material cost savings. Purocel™ 510, for instance, is regenerable, for greater circularity, while Purocel™ 505 has demonstrated three times higher chloride removal than conventional sorbents.

Bringing these technologies into everyday operations, supported by real-world testing and solid ESG data, is going to be crucial for wider adoption. At the same time, brands and consumers care more than ever about recycled content and transparency, pushing refiners to choose solutions that deliver both on performance and sustainability.

Towards a circular future

Pyrolysis oil represents a critical enabler of the circular economy within the petrochemical sector. By transforming plastic waste into a valuable raw material, it addresses two of the industry’s most urgent challenges, reducing environmental impact and building supply chain resilience.

While some technical hurdles remain, particularly around purification, scalability, and feedstock logistics, ongoing innovations in adsorbents, catalysts, and modular processing units are closing the gap between potential and commercial reality.

As the regulatory landscape sharpens and sustainability expectations rise, solutions that facilitate the safe and efficient use of pyrolysis oil will play an increasingly central role. Through collaboration, investment, and a commitment to innovation, the industry can unlock a cleaner, more circular future, one drop of pyrolysis oil at a time.