Trade has become increasingly politicised. In the shorter-term, on-and-off tariffs are contributing to overwhelming uncertainty, affecting global economic growth projections, curbing demand growth and generally hindering business. For the major chemical value chains, the direct tariff effects beyond demand erosion will differ. By Mariana Santos Moreira, Director, Thought Leadership for Chemical Market Analytics by OPIS, a Dow Jones Company.

A full-blown trade war would shift asset economics and reshuffle trade

Energy and feedstocks: Mainland China’s ethane/ LPG imports will likely be most affected. Import volume losses were clear in April trade data due to China’s retaliation even if ethane and/or LPG imports were reportedly exempted (although no official announcement was made). Adding to the challenges, US ethane and butane exporters are now required to apply for licenses with the US Commerce Department to ship these products to China, aiming to curb China’s progress in key industries.

Olefins: Mainland China’s imported light feed volumes will likely continue to significantly decline due to trade tensions. To date, five companies (seven crackers) in mainland China use imported ethane/ propane as feedstock, accounting for 7.15 million metric tons of capacity. A 125% tariff would effectively render the economics unviable. Notably, the ongoing truce will protect these assets until 9 August at least.

If US–China trade fragments to an extent that it affects ethane cracker economics in mainland China, there are a few other potential light olefins sources in the country. Chinese naphtha crackers would ramp up, as could methanol-to-olefins (MTO) units if economics improve. Increased output from other Asian producers could fully offset the loss.

If mainland China PE derivatives import flows are reduced, domestic supply would have to increase or sourced from Northeast Asia, Southeast Asia, India, or the Middle East.

Propane dehydrogenation (PDH) units account for more than 30% of the mainland Chinese propylene nameplate capacity, many of which import US propane. A significant spike in production costs for PDH units would severely damage their profitability.

To offset PDH production losses in mainland China, both domestic supply from other sectors and imports from other Asian countries could help. However, naphtha crackers, mixed-feed crackers, and fluid catalytic cracking (FCC) units will be limited due to propylene being a by-product. Notably, a significant China PDH production would not be filled using these options, meaning the market would tighten.

Polyolefins: Any potential domestic US market share gains from the import tariffs in the US could quickly be offset by additional export tariffs if affected trade partners retaliate. The United States exports much more PE resin and finished goods to affected countries than it imports, thus the overall tariff impact is likely to negatively impact US producers who are unable to shift these exports to less punitive markets.

Additionally, if producers in mainland China lose the United States as a finished PE and PP products export destination, this could reduce domestic PE and PP demand. European market participants are also concerned regarding a potential shift of low-cost mainland Chinese finished goods to the European market.

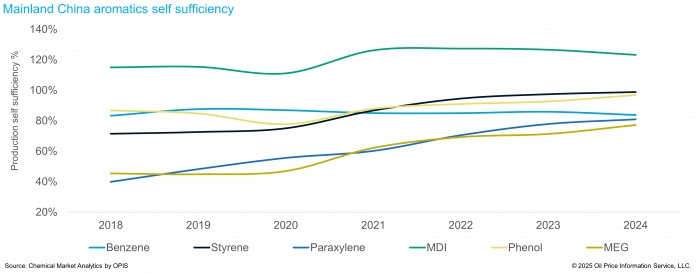

Aromatics: Benzene, paraxylene, and methylene diphenyl diisocyanate (MDI) have large US imports relative to their market size and could be significantly impacted by tariffs. Mainland China is the top MDI supplier to the US, thus import tariffs will benefit domestic producers. The US is a large styrene and monoethylene glycol (MEG) exporter and is susceptible to retaliatory tariffs. The ultimate impact, however, is more complex, as feedstock, intermediates, and downstream demand are being impacted and can move in different directions.

Benzene global trade would soon reroute despite tariffs. For now, pauses, truces and exemptions are protecting many market participants, yet shifts have started: In April, EU benzene was shipped to mainland China rather than the US.

Polyester: The United States remains a net polyethylene terephthalate (PET) importer (1.4M metric tons imported in 2024), mainly from Southeast Asia, Mexico, and Canada. PET benefits from tariff-free status under the USMCA when traded within the region and is exempt from the 10% universal tariffs.

That said, tariffs on other vital feedstocks like PX and PTA from non-North American countries may increase production costs and force a revaluation of sourcing strategies. As US PET production costs rise due to both feedstock tariffs and the antimony catalyst export ban (imposed in December 2024), current tariff differentials across the PET stream could lead to a greater reliance on PET imports and a potential decline in US production.

Inorganics: PVC resin, compounds, and finished products as well as caustic soda imports will be affected by 10% import tariffs and reciprocal tariffs, if reinstated. In general, international companies will likely pass on the tariffs to the end consumer, eventually slowing demand.

Due to the high downstream demand exposure to sectors vulnerable to the tariffs’ impact (such as durable goods, construction, infrastructure, and automotive), global chlorine demand will erode more than caustic soda and low chlor-alkali operating rates will prevail.

The long-term negative consequences of a full-blown trade war far exceed the short-term effects—but will there also be winners?

There are no absolute winners in a trade war, but some are better positioned than others as export competitiveness changes with the new tariffs and ensuing agreements.

Asian manufacturers are unlikely to reshore to the US, but export-oriented investment flows will likely shift within the region, benefiting countries like Singapore, Indonesia, the Philippines, and Malaysia. To create greater flexibility and optionality, businesses can select multiple locations to source from or operate in.

Mainland China has been restricting foreign investment into the US, with India and Mexico emerging as alternatives. India is fairly shielded from the current geopolitical tensions, so it is particularly well-positioned to be a winner in the new world order. Other Asian economies could also benefit from companies operating in mainland China that want to relocate.

From a petrochemicals investment perspective, Asian and European naphtha-based producers will benefit from lower costs if oil prices decrease on dim demand, delaying asset shutdowns in these higher-cost regions. Low-cost ethane-based producers in the Middle East, Canada, and Mexico that are free to ship light olefins and derivatives to mainland China will be able to fill the import gap from the US, which could prompt investments in these regions.

Global chemical supply chains structures will change

Short-term, economic and demand fallout from the tariffs lengthened the tough and is triggering “uncertainty paralysis” in investments and strategic decisions. These challenges will not last forever. New geographies to trade with, business partners, and supply chain efficiencies will be unveiled in the current environment. Investment flows will shift, likely diverted to secure a global presence across multiple geopolitical alliance areas, and chemical producers in geopolitically favourable nations will be at an advantage.