Chemical supply chain businesses are increasingly questioning whether the Government wants a viable domestic chemical sector to survive in the UK, says Tim Doggett, CEO of the Chemical Business Association.

A new CBA survey has found dwindling confidence, rising costs and mounting uncertainty across the industry.

The Autumn 2025 Budget Survey found a near-universal lack of confidence in the Government’s economic direction.

Respondents cited the absence of a clear strategy, rising employment costs and persistent regulatory uncertainty as key factors undermining investment, innovation and long-term planning.

More than 96% of respondents said there is a lack of clarity in the Government’s plans for the sector, while around 80% reported that their business has already been negatively impacted by Government actions and decisions.

According to the survey, business concerns fall into three broad categories: challenges arising directly from Government policies and actions; long-standing challenges facing the UK chemical supply chain; and global pressures affecting international trade and competitiveness.

While respondents acknowledged external factors such as the global economic slowdown, US tariffs and competition from low-cost imports, many were clear that domestic policy uncertainty is the primary driver of declining confidence, raising fundamental questions about Government’s commitment to maintaining a competitive domestic chemical sector.

Among policies introduced by the current Government, rising employment costs, particularly National Insurance, emerged as the single most frequently cited issue.

According to respondents, these costs are squeezing already tight margins, contributing to hiring freezes and delaying investment decisions.

Alongside employment costs, ongoing uncertainty and delays around UK REACH were repeatedly highlighted as compounding pressures on the sector.

Respondents said the lack of clarity is hindering innovation and new product development while discouraging overseas suppliers from supporting UK operations.

Many warned that continued inaction and procrastination risks accelerating the offshoring of chemical activity, further weakening the UK’s industrial base.

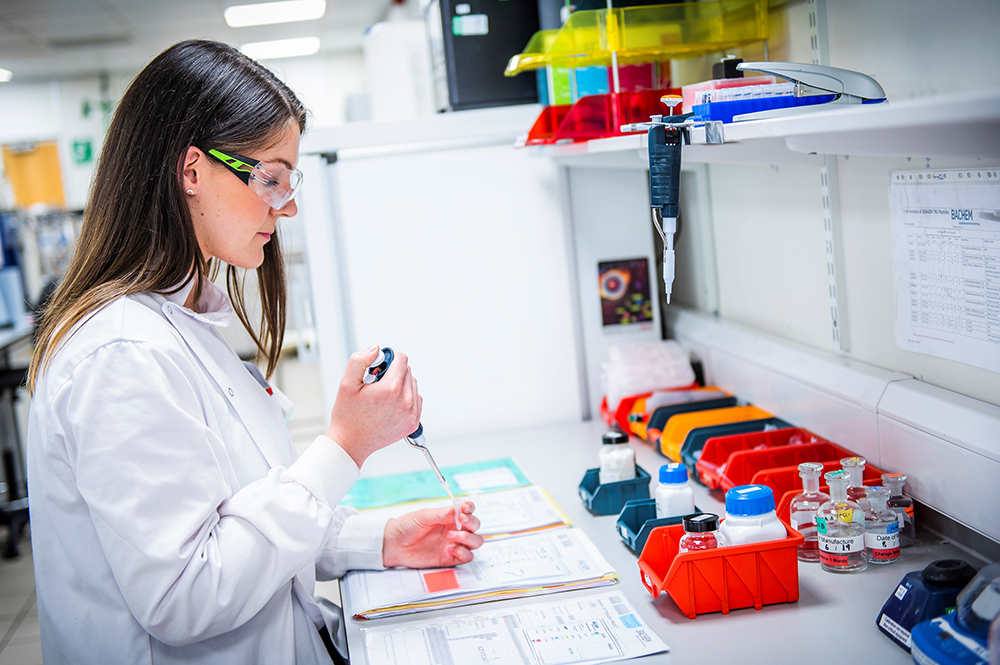

A recurring theme throughout the survey was the perception that the strategic importance of the chemical sector is being overlooked by Government, despite its foundational role in enabling virtually all downstream industries including pharmaceuticals, food and drink, energy, defence and manufacturing.

High energy prices, weak trade arrangements and increasing regulatory divergence were also cited as accelerating the UK’s loss of competitiveness, reinforcing the perception that chemicals are no longer viewed as strategically important.

Respondents further highlighted global challenges, including competition from Chinese imports, US tariffs, and a subdued global economy. However, many stressed that these pressures are being significantly amplified by domestic policy instability.

Around two-thirds of respondents said they expect the outlook for the coming period to remain challenging, with little or no opportunity for growth – particularly within the UK market. That said, around a third of businesses identified areas of relative resilience and potential growth, notably in food, cosmetics and defence.

Tim said: “This survey shows a sector under growing strain, facing a combination of long-standing challenges alongside new and intensifying pressures.

“Most concerning is that many of our members are now experiencing significant business challenges because of government actions and decisions and are openly questioning whether Government is capable of creating the conditions needed for growth.

“Chemical businesses have proven time and again that they are resilient and pragmatic, but confidence matters.

“The sector now needs a clear signal of commitment from Government and explicit recognition of its strategic importance – not just as an industry in its own right, but as a critical enabler of many others. More than 96% of all manufactured products in the UK rely on inputs from the chemicals industry.

“Without clarity, stability and a credible long-term strategy, the UK risks losing ever more strategically important capability that would be extremely difficult, if not impossible, to replace.

“Too often, it appears to take a crisis before the strategic importance of the chemical sector is fully recognised – and the clear warning signs highlighted in this survey should not be ignored.

“The hard-earned lessons of the pandemic, which exposed just how vulnerable chemical supply chains can be, appear to be increasingly ignored or forgotten.”

He concluded: “The warning signs are clear. Without decisive action to restore confidence and competitiveness, the UK risks sleepwalking into a crisis that will undermine its industrial base, supply chain resilience and national security.”